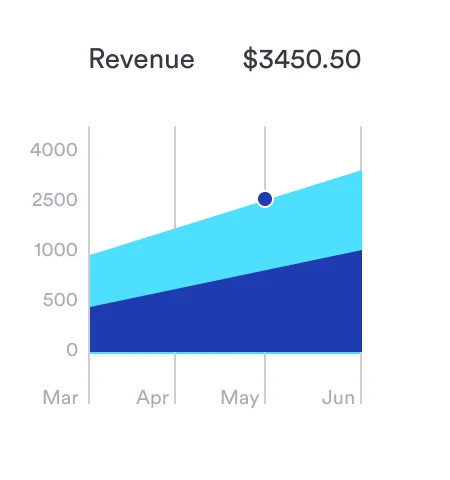

REAL-TIME CREDIT DECISIONING

Smarter Decisions with Intelligent Automation & Data-driven Precision

Empowers Banks, Financial Services, and Insurance (BFSI) to assess credit risk, approve loans, and adapt lending strategies with unprecedented speed and accuracy.

Built on intelligent decision automation technology, with the combination of business rules, machine learning, and advanced analytics to streamline loan approvals, reduce risk exposure, and enhance customer experience.

TRANSFORMING CREDIT DECISIONING

Optimized for Real-Time Lending Decisions with Full Compliance Tracking

Built on a powerful graphical decision automation platform, it enables the implementation, testing, simulation, and optimization of any internal banking decision services, including but not limited to risk scoring, pricing and credit decisioning strategies.

- Real-time processing for faster approvals

- Advanced scoring models and data integration

- Streamlined workflows and low-code configuration

Low-Code Rule Modeling

Empower business teams to design, test, and deploy decision models without heavy IT reliance.

End-to-End Automation

Integrate with core banking, CRM, LOS, and credit bureau systems for a straight-through processing experience.

Comprehensive Audit Trail

Maintain full transparency with detailed logs for every decision, supporting compliance and governance needs.

Model Lifecycle Management

Git-based version control, automated deployments, and rollback capabilities ensure agility and security.

WHY CHOOSE OUR CREDIT DECISION ENGINE?

Technology with Proven APAC Market Expertise

- Local support and training through certified partners

- Integrates seamlessly with core banking systems, LOS, and credit rating agencies

- Reduces operational overhead through automation and streamlined workflows

Get Connected with Our Specialist Today

Your goals are individual. We believe business advice should be too.