Leveraging Solutions for The Upcoming BNPL Regulation

Buy Now, Pay Later (BNPL) has been gaining traction lately towards Malaysian consumers for its ease of use. The convenience of repaying purchases later allows consumers to manage their payments more wisely without any worry. According to the Consumer Credit Oversight Board (CCOB), there are 2.9 million active BNPL users in Malaysia.

From that number, 44% are aged 21 to 30 years old, and 47% are 31 to 45 years old, mostly considered as the younger generation. The recorded transaction values of BNPL range from RM40 to RM500, or an RM84 spending average in multiple sectors, such as commercial, retail, food, entertainment, transport, and accommodation.

At its root, BNPL transactions are still a form of credit, therefore it depends on consumers to be responsible for their credit health. Despite being a relatively similar concept to credit cards, the simplicity of using the scheme at the touch of a screen has appealed to many consumers, especially for the younger generation who primarily use it for smaller purchases.

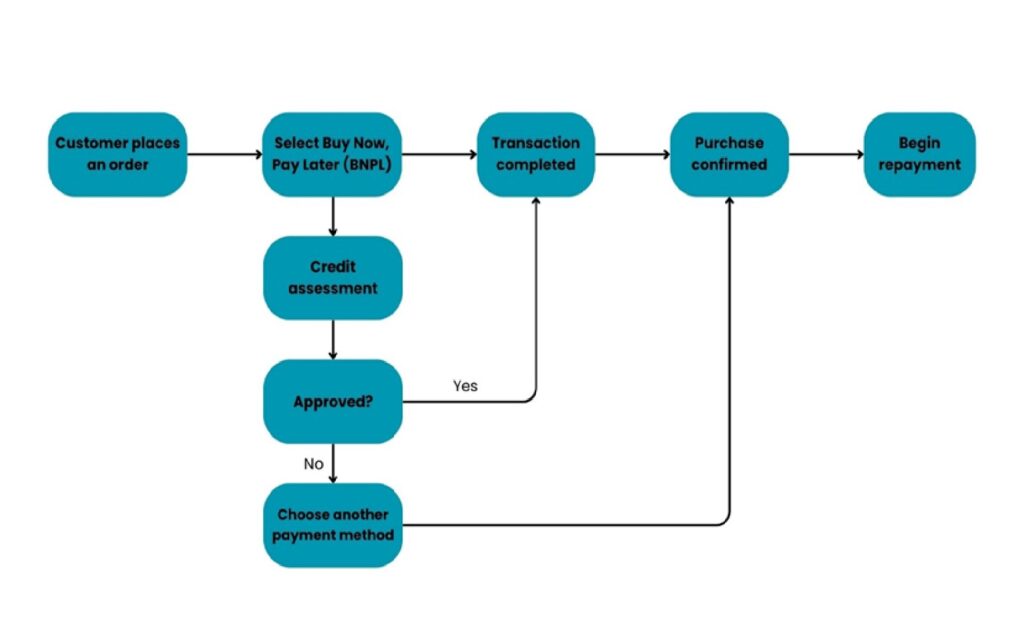

The BNPL process starts with consumers selecting the service at online store checkouts, where their profiles would be analysed for credit risk levels. Once approved, their purchase would be processed accordingly. On a monthly basis, consumers would then have to repay back their purchases to the service provider in small instalments, which will be paid back to the online store owner.

Unregulated BNPL: Weak Credit Assessments and the Rise in Consumer Debt

According to a research paper by Zainudin and Othman, the fast development in the BNPL scheme has been subjected to uncertain regulations, causing concerns for lack of financial safety. The most significant concern is weak credit standing assessments of consumers. The application process of BNPL services appeals to many due to its simple requirements that do not take actual financial standings into consideration.

This might cause consumers of a weaker financial position to not pay back their installments on time. This, in turn, leads to an increase in delayed payments. Furthermore, service providers do not adhere to strict credit assessment requirements, putting the true creditworthiness of a consumer at a bare minimum than normal.

The lack of standardised regulations for BNPL service providers allows them to form their own types of regulations to manage overspending. Companies like Grab have a limit based on the user’s background and spending habits, which can change depending on the transaction and usage frequency, if late payments occur, the account will be frozen and a reactivation fee is imposed.

Alternatively, temporary measures can be implemented to control and standardised BNPL service providers by adopting credit solutions to filter those who are financially stable to make repayments and those who cannot afford them.

Getting Ready for The Upcoming Regulations Affecting Credit Platforms

Trisilco specializes in compliance, regulatory reporting, and credit decisioning tools for financial institutions. We have vast experience in providing a platform that can retrieve credit reports and also submit credit data to regulatory bodies.

For example, we have a solution called Syndesis and Universo. Both solutions have been used by more than 50 financial institutions in Malaysia to ease their compliance and regulatory reporting.

Our Syndesis platform operates as a front-end service where service providers like BNPL can use the solution to assess consumer credit background and market information before approving any credit transactions. This process helps to determine the consumer’s financial health.

Detailed information from Syndesis allows transparency of credit responsibility, assuring that consumers are capable in their spending and repayments so that BNPL service providers deem them worthy of using their services.

On the other hand, our Universo is the back-end solution that has the capability to extract, load, and transform the data into standardized reports based on regulatory requirements. This report can contain information such as customer details, credit details, recent payments, or any other information required by the regulatory bodies.

Regulatory reporting promotes transparency and fairness in the credit market. It’s also allowed regulatory bodies to be aware of consumer spending habits and credit responsibility, especially for BNPL spending that is being widely used right now. With accurate and comprehensive credit information, we will have a better monitoring of systemic risk and help prevent over-indebtedness and financial crises.

The simplicity of BNPL services makes them increasingly popular among young Malaysian consumers, however, the lack of standardized credit checks and established procedures can lead to declining financial health. So, if you’re interested to learn more about our solutions, feel free to write to marketing@trisilco.com