The data consistency & accuracy is based on a guideline known as Data Quality Framework (DQF) issued by the Central Bank. The framework comprises multiple layers. Data Source Layer is the initial tier where data is acquired from financial institutions, compiled with statistical reporting, which is then integrated into a repository layer where the data is stored in a “data warehouse” and accessed accordingly. Once this is validated, the data is then crunched and disseminated into financial statements, industry-specific news according to different sectors. Upon dissemination of the data, reports are then produced to formulate a standard reporting for banks to follow.

Ideally, DQF is a tool for data submission monitoring. It furnishes banks with comprehensive data to monitor so that submission is made in a timely manner. Secondly, it provides banks with data quality checking within the systems. It is divided into backend and frontend, which highlights micro and macro checking, as well as custom reporting.

Micro checking reports are for bankers to ensure every application is reported accurately and submission is fulfilled, based on Central Bank’s guidelines. What it does is, it identifies any missing relationship between each record, such as missing master account, missing sub-account, and missing account collateral, etc. Any missing information would be flagged as inaccurate reporting.

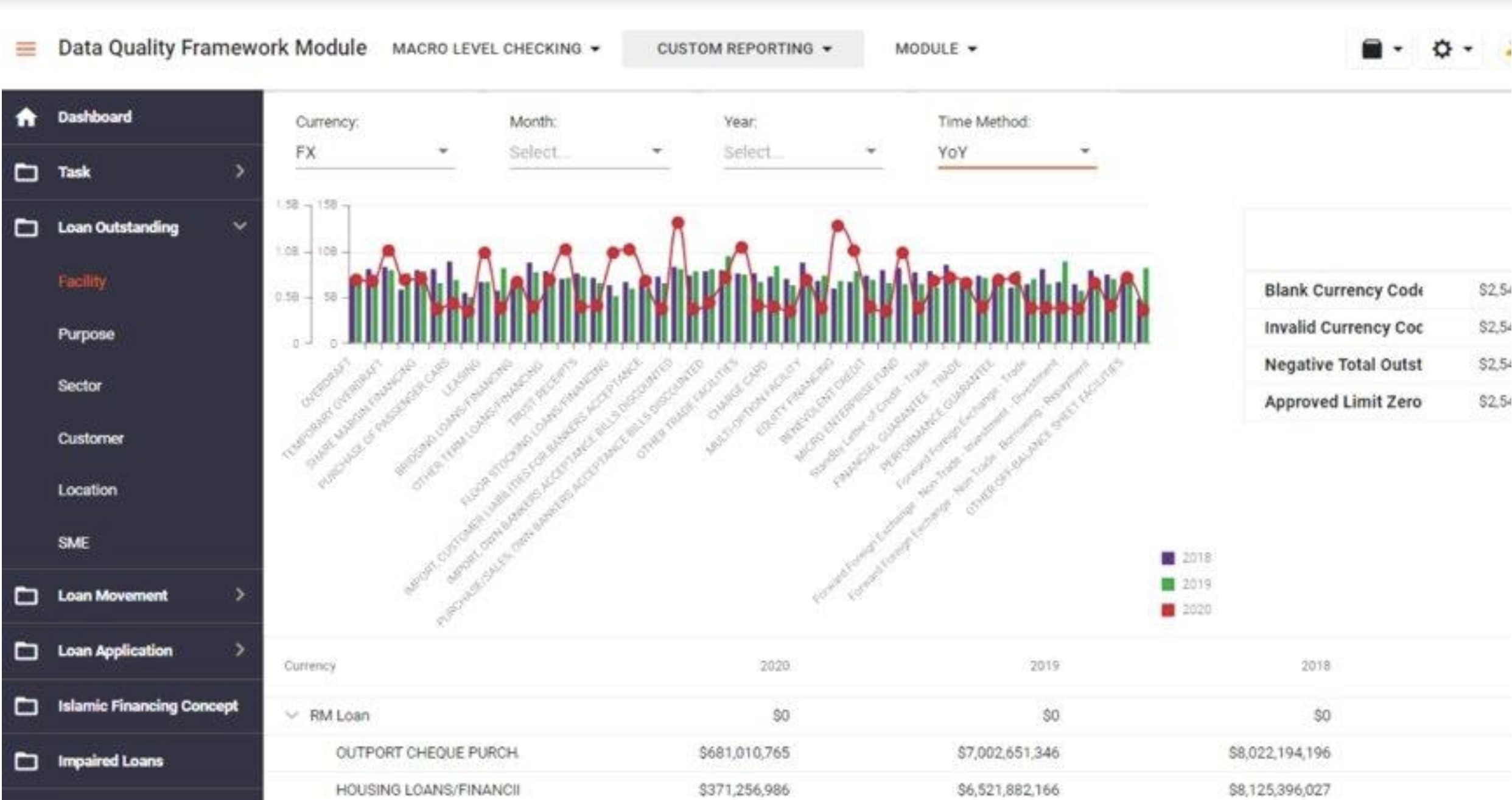

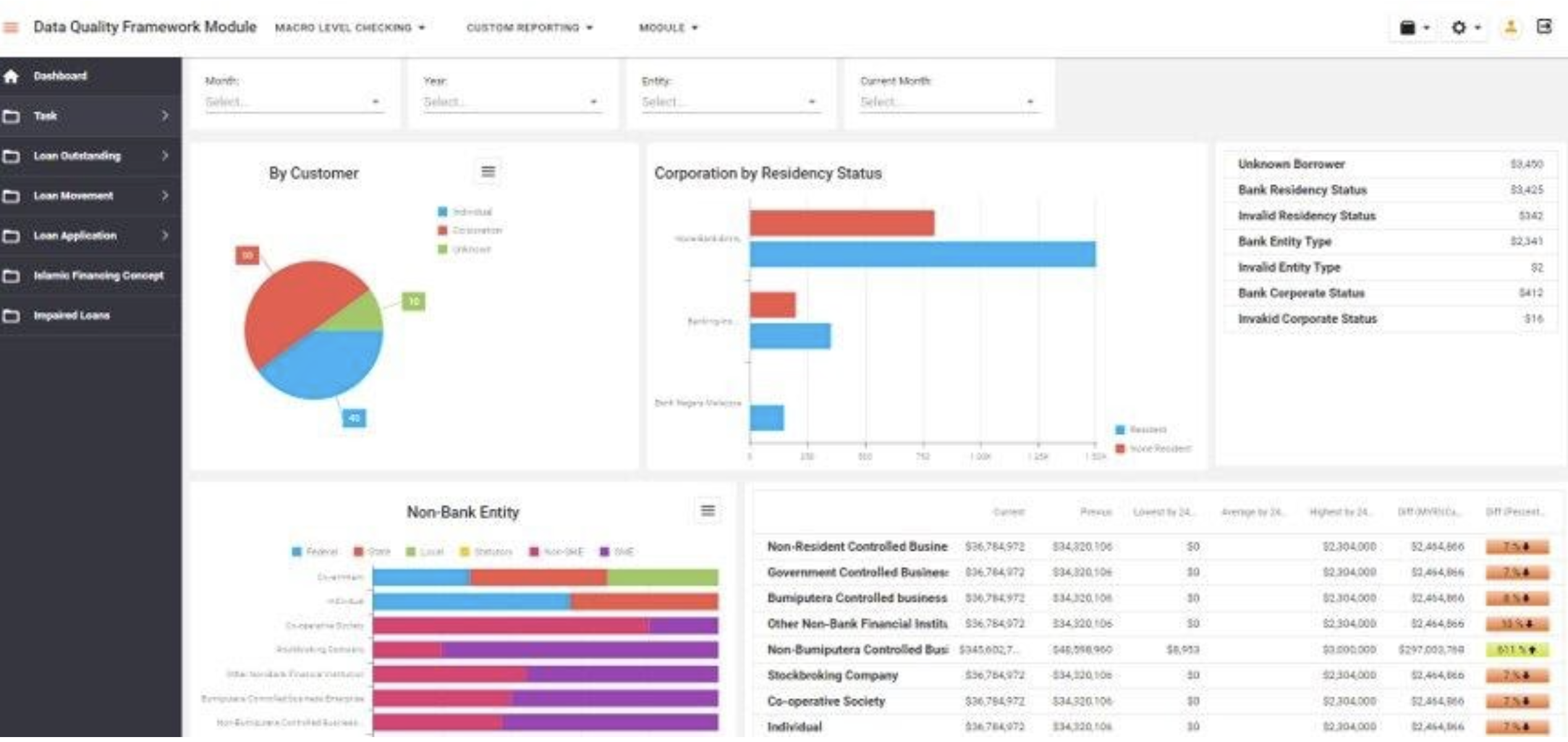

Macro checking reports, on the other hand, focuses on information related to outstanding loans, net loan disbursements vs. outstanding loans, as well as the total number and amount of loans approved. This reporting is done to have a statistical average by comparing current data value and to gauge the month-on-month and year-on-year averages. Other data analysed are Islamic Financing by Concept (Micro, Small and Medium), loans outstanding to SME, impaired loans, gross loan approved limit vs. gross loans outstanding, number of utilised loans vs. total loans outstanding, etc.

The DQF also provides a check and balance on any significant variance against normal trends of previous submissions. The framework contains self-explanatory reasons, causes, and triggers if something is reported anomaly.

As DQF has its technicalities, at Trisilco, we provide the tools to ease bankers’ experience on the reporting process. We provide the know-how for banks to address and solve issues to minimize rejections due to inaccurate reporting. The tools that Trisilco offers provide flexibility, expandability, and accessibility with easy reporting streams, combined with analytical and comparison benefits.

The key benefit is it provides safe record-keeping, utilizing dynamic business rules. It also offers data source tiers that categorize and support a variety of data sources that are expandable and importable from other reporting streams. Some of the methods that are used in the reporting process are dynamic reports, trend analysis, and drag-and-drop options offering users a transparent and user-friendly way to work on the reporting process.

CCRIS reporting by banks requires training and competence for accuracy. Universo DQF Framework is one, and the other is the DQF Design Strategy. The design strategy supports the staging, business rules validation, reporting analytics for CCRIS, and other streams. The DQF framework and design strategy combine into one complete solution.